Five Things You Should Know About the Michigan Statute of Limitations

Worried about old, overdue balances on the books?

Unsure how to pursue payment on old accounts?

Our experts on attorneys understand that handling long overdue accounts can be a time consuming and stressful job.

These accounts should be turned over to a debt collection professional as soon as possible to avoid having your account eliminated by the statute of limitations. Here are the five things you should know about Michigan SOLs on debt.

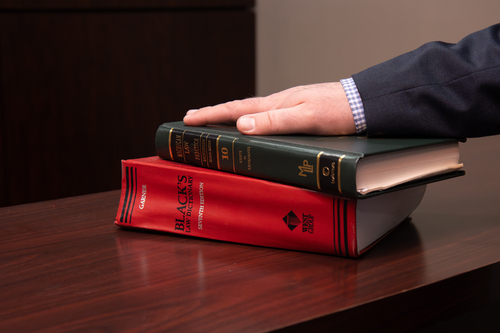

- As a creditor, the statute of limitations sets the time period for you to take legal action against a debtor.

- The statute of limitation is six years for most written or oral contracts. The countdown does not begin until the customer misses the first payment or defaults on the terms of the contract. The statute could be renewed when a new payment is made.

- If your agreement or contract with your customer was for the sale of goods, you would normally only have four years to start a legal action to recover on the outstanding balance.

- The statute may be revived in a few different ways. A partial payment can reset the clock, even if the SOL has long passed. The legal term for an action that restarts the statute of limitations is a NOVATION. Under most state law, the partial payment could toll the statute all over again as of the date of payment.

- You may still have a legal case on a very old debt. Our Michigan collection services can assist you in determining the best course of action for your company.

A little bit of information can go a long way; knowing more about your rights to pursue payment you’re owed can help turn hesitation into action. These facts should help you make some decisions on old, open accounts you’ve had on the back-burner for a while.

Take the Pressure Off with Michigan Collection Services

If you find that taking action on several outstanding accounts is more than you can handle on your own, we can help! Our attorneys have the tools to get the job done effectively and ethically. Call 248-645-2440 or fill out our quick online contact form to get started!